can I retire early? It’s in the cash flow...

Financial advisors say to only withdraw 4-5% of your total assets each year after you retire. So if we are not earning it and only spending it, what will 4-5% look like? If you’re in your 50s, take a good hard look at your financial circumstances, whether you’re single, married or widowed.

For some, retirement will come out of left field, through company attrition or downsizing. Sometimes a forceful way out of the building is the best way (okay, maybe the only way) to kickstart early retirement. You have no choice in this case but start to plan your next steps. Many companies have retirement policies where you retire at 65, but there is no law where I live that you have to retire at that age. You can work as long as you want to but who wants to do THAT? Unfortunately, many middle-income earners need to continue to build their nest eggs well into retirement.

The government pension can be drawn anytime between the ages of 60 and 70. The longer you wait to draw, the more you receive. But don’t get too excited, it’s not enough to live on. I only have my deceased mother as an example. She could not afford much with her government pensions. She also did not work for several years prior to officially retiring. Everyone is in a different situation financially. She moved in with us the last five years of her life.

If you’re anything like me, you’re starting to think about what your future as a retiree will look like.

What will I do with my free time? If you love to dig your heels into new opportunities or you’re just a busy body that needs to keep moving or you’ll die from boredom, join the club.

Check out the free self-awareness quiz “Worry Warts Beware If Retirement is Near” to ask yourself these 25 things [and answer them truthfully]

I may officially retire early, but i will always work...

It’s who I am.

I love learning new skills and trying something different. I like the entrepreneurial mindset and the thought of running my own business when I retire, and have it mostly automated. I’ve worked on making passive income for a few years now in my spare time. It took a lot of work to set it up but it’s easier when you lean on others who know more about it than you do. I’m not going to get rich overnight – it’s definitely a process, and a test of one’s patience, but learning how to do it is part of the process and the outcome can be magic. The money comes after the business is pretty much on autopilot! I share more about the mentor who helped me below (or jump that section now).

The word “retirement” is either music to your ears, or a real stressor in your life.

How does the word “retirement” affect you? Will you be able to retire early, on schedule or not at all (either by choice or not?)…

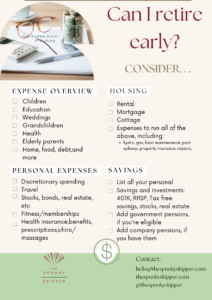

Here is a chart to help you decide if you can and want to retire early. It’s not exhaustive, but an eye opener.

To retire early, we need to assess our current expenses ….

Do you want to live your same lifestyle once you’re retired, financially speaking? Consider your standard of living. You’ll need to assess your situation. Will you be able to afford the same lifestyle if you are still carrying debt? If you hope to pay off the debt, how long will it take? What can you do now to start paying off more debt? That’s one of the reasons I started an online business, to pay some debt and set myself up to enjoy retirement. And if you want to learn more about how to start an online business. Check out the Challenge -new learning sessions pretty much every month, conducted by one of my mentors Keala Kanae – he’s a real rags-to-riches story. Truly inspiring. The best part is he wants you to be successful in your own business and pulls out all the stops to make sure you get the training you need. You can learn more about him in this video.

I’ve also purchased some stocks and opened a tax-free savings account – not through a broker, but through Questrade. They give you two great ways to invest with lower fees: buy and sell your own investments or get a pre-built portfolio. I’ve never purchased my own stocks, but thought I would test my skills. I also follow Motley Fool for recommendations. Here’s an article on retirement strategies you might find useful, as well as this tool Retirement Planning:How to map out your financial success

If you need more direct assistance with retirement planning you can sign up for one of Motley’s bundle packages here.

Let's go over different aspects of our lifestyles to see if we can retire early...

Expenses

Full-time work will stop after retirement, but expenses won’t. Keep these expenses in mind during your planning

They only grow up from here!

CHILDREN

If you retire young, children who are not yet financially independent may still be under your care.

EDUCATION

Do you plan to help with your children’s education or are they on their own? How long will they be in school? What expenses are coming out of your pockets?

WEDDINGS

How many kids, how many weddings? Whare your plans to support the weddings? They are meaningful events, after all.

GRANDCHILDREN

all They may be a few years away (or not!). As grandparents we are suckers for the grandkids (you know, you can spent quality time with them and then give them back LOL). I’ll let you know when I have them. How do you want to support the grandkids? Visits, trips, education, birthdays, etc.

health

Health problems can hit us anytime. We may be healthy now, but do we ever plan for “just in case?” Insurance plans and benefits coverage will look differently the older we get.

It certainly doesn’t get easier as we age, nor less expensive.

Yoga, pilates, walking, biking or Zumba like me, keeps you active, young and alive!

MEDICAL COVERAGE

Medicare for seniors is getting more expensive, meaning U.S. patients are expected to pay more out of pocket for certain medical needs. Medicare has two parts Part B and D. In Canada, we have various forms of province wide insurance coverage. In Ontario, where I live, it’s OHIP – Ontario Health Insurance Plan, paid for mostly by working residents as part of their taxes. We ARE taxed to death in Canada, particularly the middle-income wage earners. OHIP is one benefit, I’m happy to pay for. Seniors get most of their medications covered by the Ontario Drug Benefit, which covers nearly 5,000 prescription drugs, physiotherapy, vision care, home care services, according to Seasons Retirement Community. If you’re a snow bird, flying south for several months of the year, you are required to be living in Ontario as a resident for 153 days of the year.

Health expectancies have increased overtime, so expect to live longer, but prepare for it.

DENTAL COVERAGE

Dental care is typically not covered for seniors, however the government launched a new program for low-income seniors in 2019 that will help, if you’re eligible. Otherwise, you’re on your own to pay for dental, either out of your own pocket or thorugh private insurance that pay for – either way you pay for it. If you’re in the U.S, again, Medicare maybe of assistance, but it doesn’t cover dental fillings, clenaings, root canals and dentures. If you fall into a certain income bracket, you may have a state-wide grant you can apply for.

MOBILITY ISSUES

If you’re in your 50s now and hope to retire early, hopefully you’re active and mobile and can really enjoy your “next” life doing the things you love. As we age our muscle get weaker, our joints start to ache (I can feel mine starting to ache after I’ve worked out). Hopefully, there’s nothing else debilitating you now. However, that may not always be the case, so it’s important to walk, stretch and do functional type exercises to stay agile, and take supplements.

Should mobility issues arise from a neurological disease, accident or other ailments, then you may need to consider renos to accommodate a wheelchair or other equipment.

ELDERLY PARENTS

Do you expect your parent(s) to live with you at any point in their lives? Are they healthy or will they have special needs, medications, medical apparatus, ramps, wheelchairs, special trips to hospital or doctors.? Elderly parents need emotionally support as well. Things to consider.

housing

Health problems can hit us anytime. We may be healthy now, but do we ever plan for “just in case?” Insurance plans and benefits coverage will look differently the older we get.

It certainly doesn’t get easier as we age, nor less expensive.

Mortgage, Rental apt, Adult community, Monthly expenses

RENTALS

Average monthly rent for a 2-bedroom apartment in the U.S. is $1,295. If you decide to sell your home and move to a rental, that’s what it will cost, on average. Of course, it totally depends on the city or town. As of December 24, 2022, the average rent for a one-bedroom apartment in Toronto, Ontario Canada is $2,272 ($1675 US), according to Zumper,an online rental company. “This is a 25% increase compared to the previous year.”

If you own your own home- either still paying the mortgage or living mortgage-free (best bet), consider your monthly expenses: taxes, electricity/gas/water, lawn maintenance, property maintenance (roof, high-price ticket items, furnace, heater, air conditioner, etc)

LIVING EXPENSES

Besides housing, what about vehicles? One car or two? Do you have other recreational vehicles? Do you want other recreational vehicles? Consider storage.

Household

Daily household expenses include food, transportation, gas, and likely more.

Monthly expenses

Water, electricity, heating, gas, telephone, credit cards, cable, internet, As a renter, some of these bills such as water, sewer and garbage collection, maybe included in your monthly rentals.

Maintenance

Should mobility issues arise from a neurological disease, accident or other ailments, then you may need to consider renos to accommodate a wheelchair or other equipment. As you grow older, your house grows older with you.

Prepare for roof repairs, replacement of air filters, plumbing, emergency fixes.

You may allocate an emergency fund for these types of expenses. In other words, expect the unexpected.

“As a general rule, you should expect your annual home maintenance costs to be between 1% to 4% of your home’s value.”

personal expenses

These expenses include what you can call seasonal items such as clothing, footwear, memberships, subscriptions, and other payments towards things you love. Will you keep up all of them when you retire? Personal care products and hobbies can also make a dent in your budget. You want to buy books if you love reading, tools and materials if you love crafting, and tickets if you love entertainment.

Review what you can and cannot live without and start whittling things down.

Reading, crafting, cruising, traveling. What can't you live without when you retire?

TRAVEL

A lot of folks say they’d love to travel when they retire, but in my experience, and from what I’ve read, those who travel upon retirement simply continue to do what they’ve always done. If you were never one for traveling in the first place, the chances of you getting the travel bug in your 50s, 60s or even 70s is highly unlikely. I mean, you may want to explore a new state, province or country once a year or every two years, but regular travels are likely not something you will aspire to do “once” you retire. This same logic goes with many other things.

If you’ve never had a green thumb – or more likely, if you’ve never loved gardening, you’re not likely to start loving it later in life. I may be wrong, and you may suddenly start to love flowers, plants, shrubs and greenery, but I doubt it. However, If you are into travel, plan for it every year so that you put money aside to pay for it and avoid stressing out over money. You want to enjoy your time away.

CLOTHING, MEMBERSHIPS, HOBBIES, SIDE BUSINESS

Really consider your passions and what you can’t live without. Do you want to start an online business or turn your hobby in to a business? Do you want to spend each day mainly close to home, without traveling? Do you love, I mean LOVE, fashion and need that next trend or are you happy with the staples, and keeping it minimalist.

Savings

It is never too early to start saving, but sometimes it can be too late.

Remember the “compound interest” formula – well that pretty much goes out the window later in life. So you have to be smarter and reduce debt early, add a bit more to your RRSPs or 401(K), and put more on your mortgage to knock it down sooner.

Inflation will never go away, and our purchasing power goes down. So what was once worth X dollars will not be worth the same 10-20 years from now.

Savings, investments, side business...

INVESTMENTS

Stocks

Research established public companies and start buying shares. You can also look into good and trustworthy companies you think will last for a long time like bank institutions (we all know how much money they make). You can generate income from your stocks. Sell it when it is valued above what you’ve paid for.

If you can swing it, real estate investing can generate a passive income. By investing you can build financial security because real estate properties mostly appreciate over time.

You can rent out your properties. If it is a real estate used for business purposes, you can rent it out as grocery stores, cafes, restaurants, other promising businesses. And if you have an underdeveloped land, you can lease it out for manufacturing plants or warehouses.

Read enough?

Time to plan for the early retirement of your dreams. If you can only retire when “due date” comes, for most of us it’s 65, then make the best of it. Take the extra time you have to plan ahead. I wish you the best of luck as you plan, and please share your experiences by leaving a comment. We want to hear about the good, the bad and the ugly of planning for retirement. Don’t forget to take the free self-assessment to determine if you’ll be able to retire early. Here’s the link again.

Resources

Business Launch Challenge with guru Keala Kanae. Believe me, if you need hand-holding to start an online business this is the 3-day virtual weekend you want jump into for less then $60. I’m talking: learn about setting up a website, learn how to write emails, learn how to generate leads to your offer; learn how and where to find offers. The entire workshop is virtual, from the comfort of your home. I took it, had fun and learned so much – click here to find out more start your own online business challenge

The Motley Fool offers the best expert investment guidance. I regularly look up information. Right now they are running a special introductory offer for $89 for new members. Click on this banner link to learn more.

Track your actual pre-retirement spending for a year brought to you by the Retirement Manifesto –Spending Tracker.

Other articles you may be interested in…

The Spunky Skipper is a personal website and when applicable we will talk about or show products that we may have used and recommend by linking you to those items on affiliate sites. When you purchase through those links we earn a small percentage of a sale at no cost to you. We appreciate your loyalty and support.